by LDeX Group | Jan 31, 2018 | Blog, Press

Company says it has spent over $30bn in IT infrastructure over three years, but warns it’s “not done yet” as its now seen as a communications brand instead of IT.

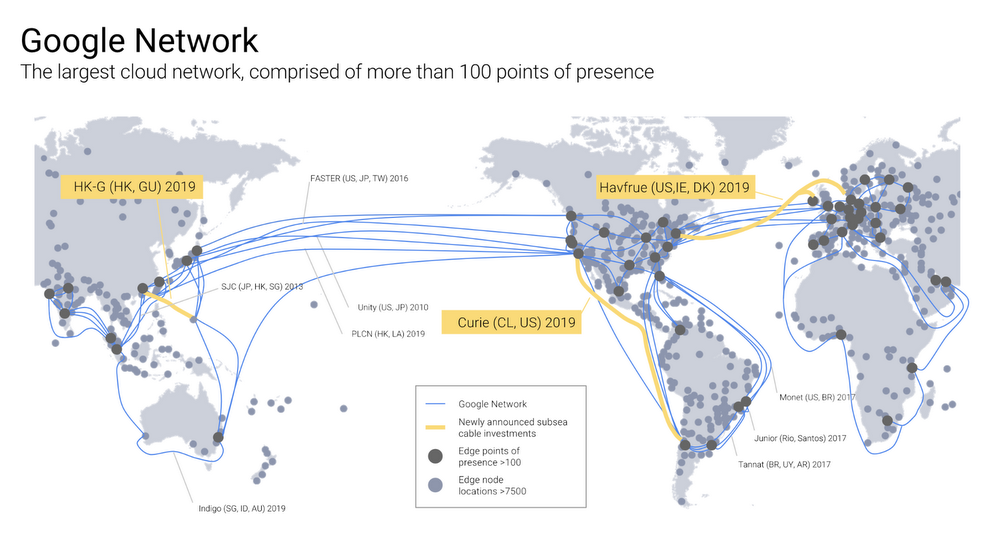

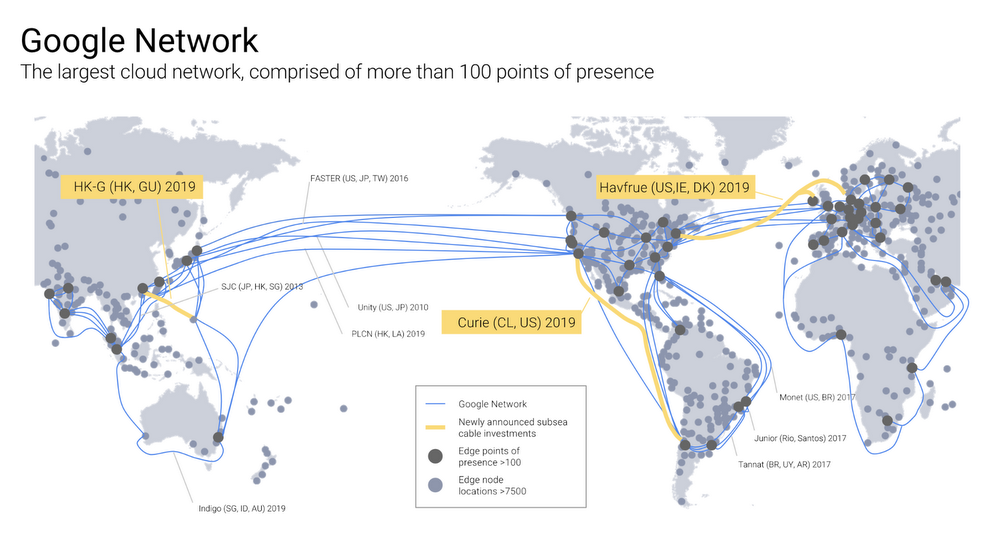

Google has announced the opening of several cloud regions and data centres across the world, as well as the commission of three subsea cables.The company is to open regions in the Netherlands and Montreal, Canada, before the end of March this year.The two new regions will be followed by Los Angeles (US), Finland and Hong Kong, “with more to come”. Additionally, Google will also commission three subsea cables to be laid in the Atlantic and Pacific oceans. The underwater infrastructure is to be commissioned in 2019.

Which cable has been named by the public cloud and content delivery giant. Curie will be a private cable connecting Chile to Los Angeles; Havfrue will be a consortium cable connecting the US to Denmark and Ireland; and the Hong Kong-Guam Cable system (HK-G) will be a consortium cable interconnecting major subsea communication hubs in Asia.

Google claims to be the first major non-telecom company to build a private intercontinental cable with Curie.

In fact, Google’s claim comes just days after S&P Global Inc. positioned Google – and Facebook – under the category of communications, exiting the information technology vertical.

The communications category is also expected to take over telecoms as the merger of telecommunications companies is expected with several internet and media stocks, Bloomberg reports.

Google’s VP Ben Treynor Sloss, said: “By deploying our own private subsea cable, we help improve global connectivity while providing value to our customers. Owning the cable ourselves has some distinct benefits.

“Since we control the design and construction process, we can fully define the cable’s technical specifications, streamline deployment and deliver service to users and customers faster. Also, once the cable is deployed, we can make routing decisions that optimize for latency and availability.”

by LDeX Group | Jan 30, 2018 | Blog, Press

Grows data centre footprint to more than 50 facilities across the world and a combined customer portfolio of more than 10,000 businesses.

IT infrastructure operator Internap (NASDAQ: INAP) has entered into a definitive agreement to acquire infrastructure as a service (IaaS) provider SingleHop in an all cash transaction worth $132m.

SingleHop is a Chicago-based company with approximately 3,000 customers across 124 countries and data centres in North America and Europe.

The combined business will result in a portfolio of more than 10,000 customers, with services presence especially increased in Chicago, New York City, Phoenix, and Amsterdam.

Internap’s footprint it to grow to more than 51 Tier-3 data centres in 21 metropolitan markets and 90 points-of-presence around the world.

The company currently manages one million gross sqf under leaser with 500,000 sqf of data centre space.

Internap will be acquiring SingleHop in an all cash deal for $132m reflecting a purchase multiple of approximately 7x after synergies, based on annualized Adjusted EBITDA of approximately $16m for 3Q 2017 and expected annualized cost synergies of $2m to $3m. INAP expects SingleHop will contribute $45m to $50m in annualised revenue post-closing.

Peter D. Aquino, President & CEO of INAP, said: “The INAP turnaround strategy includes restoring top-line organic revenue growth while leveraging smart tuck-in acquisitions to accelerate that growth.

“Today we announce significant progress on both fronts: We are reporting a positive outlook for 4Q 2017 revenue, which is up sequentially, and we are ahead of turnaround expectations. We are also pleased to announce the signing of an agreement to acquire SingleHop and welcome their customers and employees to the INAP family.”

Zak Boca, co-founder and CEO of SingleHop, said: “These two companies are extremely complementary, and together will offer customers an incredibly robust, modern IT platform, which was backed by investment firm Battery Ventures.

“SingleHop’s innovative approach to IaaS and the delivery of managed services combined with INAP’s global data center and network presence, will give clients a one-stop-shop for their IT needs. This is a strong combination that I’m very excited to be a part of. I look forward to transitioning to become the Chief Marketing Officer of INAP.”

by LDeX Group | Jan 23, 2018 | Blog, Press

Local authorities are expected to approve a new development codenamed Morning Hornet in the coming hours.

The world’s largest social media company could be about to announce one of the world’s largest data centre investments topping up to $20bn in capital expenditures on a single site over a number of years.

According to The Atlanta Business Chronicle, Facebook is expected to announce a 400-acre campus in the Greater Metro Atlanta, east of Covington.

The site is to be located at Stanton Springs, mainly in the Walton County, a new development backed by local authorities to boost the settlement of large corporate campuses, data centres, advanced manufacturing or bio-pharmaceutical facilities, or high-technology distribution centres in the region.

The Facebook project could be codenamed under “Morning Hornet”. The local Joint Development Authority for the Walton County and three other counties that also own part of the land in which Stanton Springs sits, are expected to approve the purchase and sale agreement, pre-development agreement and site access agreement of the secret development this Tuesday.

Facebook was not immediately available for comment.

According to the company’s job page, Facebook is currently looking for a construction project engineer to be “located in the South-eastern region of the United States”.

“The exact location is still to be determined,” it reads in the ad that includes Atlanta, GA, as a general location.

Additionally, Facebook has also posted job vacancies for two construction project managers to be based at the same “still to be determined” location.

If Facebook announces a hyperscale data centre campus in Atlanta, the company will be joining one of the fastest growing hosting hotspots.

by LDeX Group | Jan 12, 2018 | Blog, Press

26% of revenues come from the world’s top five metro areas alone.

Data centres are being built all over the world, however, 59% of global revenues from wholesale and retail colocation come from just 20 metro areas in North America, Europe and APAC.

According to Synergy Research Group, of those 59%, 26% come from the world’s top five metro areas alone including Washington, New York, Tokyo, London, and Shanghai. The think tank ranked the cities by revenue generated in Q3 2017.

The next 15 largest metro markets account for another third of the worldwide market. Those top 20 metros include ten in North America, four in the EMEA region and six in the APAC region.

Across the 20 largest metros, retail colocation accounted for 72% of Q3 revenues and wholesale 28%.

In Q3 Equinix was the market leader by revenue in eight of the top 20 metros and Digital Realty would be the leader in five more if a full quarter of the acquired DuPont Fabros operations were included in its numbers.

Other colocation operators that featured heavily in the top 20 metros include 21Vianet, @Tokyo, China Telecom, CoreSite, CyrusOne, Global Switch, Interxion, KDDI, NTT, SingTel and QTS.

Over the last four quarters, colocation revenue growth in the top five metros outstripped growth in the rest of the world by two percentage points, which according to Synergy, translates into the worldwide market being slowly concentrated more in those metro areas.

The Top 20 metros with annualised growth rates of 15% or more (measured in local currencies) were Shanghai, Beijing, Hong Kong and Washington/Northern Virginia.

All four saw strong growth in both the retail and wholesale segments of the market, though growth in wholesale tended to be higher. Synergy also highlighted Chicago, which has seen very strong growth in wholesale revenues, though in this metro retail colocation growth was relatively weak.

John Dinsdale, a Chief Analyst and Research Director at Synergy Research Group, said: “While we are seeing reasonably robust growth across all major metros and market segments, one number that jumps out is the wholesale growth rate in the Washington/Northern Virginia metro area.

“It is by far the largest wholesale market in the world and for it to be growing at 20% is particularly noteworthy. The broader picture is that data centre outsourcing and cloud services continue to drive the colocation market, and the geographic distribution of the world’s corporations is focusing the colocation market on a small number of major metro areas.”